Real estate demand begins to show signs of recovery in Mexico City, one of the main national markets, after the two deadliest waves of the Covid-19 pandemic. According to Lamudi’s 2021 Real Estate Report ─which offers a photograph of the real estate sector in the capital after a year and a half of health contingency─ the real estate demand grew 38% during the first four months of the year, compared to the same period in 2020.

The real estate subsector of land was the one that registered the greatest increase. That has an explanation: with the boom in digital commerce generated by the pandemic, many companies drew on the rental of land to use them as storage points and distribution of goods, explains to Forbes Mexico Daniel Narváez, Marketing Director of Lamudi.

In an interview, Narváez points out that Winning areas in this subsector were the north of Mexico City, in industrial estates such as Vallejo, as it is the entrance and exit door to the Bajío industrial corridor, and municipalities such as Iztacalco and Iztapalapa, east of the capital, that also connect with the exit to Puebla and the east of the country and have a large inventory of land.

Read also:

A ‘revival’ is coming for Reforma Norte, the forgotten side of the Paseo

Conversely, the corporate subsector shows no signs of improvement. In fact, it is the only one that continues in red. In the first four months of the year, it registered 7.6% less in the search for real estate. In this case, office corridors such as Santa Fe, Polanco, Reforma and Insurgentes are among the most affected, due to the fact that in recent years the construction of office buildings that today remain empty due to the permanence of remote work, limited capacity and the contraction of the economy caused by the pandemic has been promoted.

This Tuesday, the head of government of Mexico City, Claudia Sheinbaum, acknowledged that the program for the conversion of offices to residential buildings has not taken off. In this regard, the Lamudi spokesperson commented that the timid progress of this measure is not due to administrative procedures, since it is the government itself that encourages the migration of land uses, but rather may be due first to the production and transformation costs that developers have to bear, and the lack of a potential market that acquires the homes that can be generated for sale or rent.

“From the outset it is necessary to analyze what type of housing is going to be offered with this conversion. Many of the doubts are whether it is really going to be able to transform a corporate space into a home. There is also the issue of final sale prices, since in rent there is more flexibility. Those are the challenges at the consumer level. If it is going to be a product that is going to cost eight or nine million for being in a class A building or for the price per square meter that a certain location or neighborhood gives you, It will not be solved and that is why further progress has not yet been achieved“, Explain.

The next mixed-use developments to be built on Reforma and in a radius of one kilometer, which according to the Ministry of Urban Development and Housing (Seduvi) is 30 and represents an investment of up to 22 billion pesos, They will have to rethink office models, which are more flexible spaces and even adaptable to coworking, as hybrid or remote work will remain in many companies.

“One of the great challenges is not having unoccupied offices in the coming years. That is why the importance of the resilience of the corporate product, which can be made more flexible in terms of square meters, that are not very closed spaces, limited to a certain number of people, but that is adaptable to a coworking scheme. To the extent that they adapt to this model, their success will be. There are also many foreign, large, international companies that are looking to start operations in Mexico, ”he says.

The office real estate market in Mexico City closed the second quarter of 2021 with a total existing inventory of 10.3 million square meters of Net Profitable Area (ANR), a growth of 1.08% compared to the same period of 2020, since they were added 109,641 square meters during the last 12 months. Derived from the large amount of office space that was vacated during the first quarter of the year, the market presented a negative net absorption: -135 thousand 228 square meters. Almost 35% of the space that has been vacated is subletted.

More information:

Interview | Real estate investment of 9 thousand million pesos is coming: Secretary of Finance of the CDMX

Housing for rent

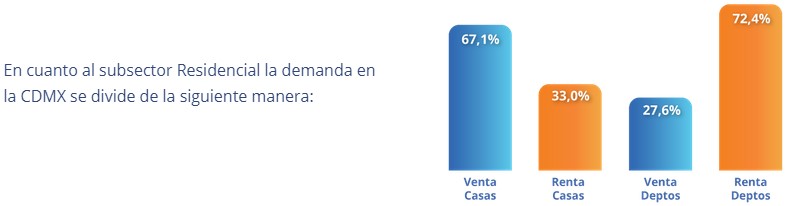

Mexico City ranks first in the digital demand ranking. By type of operation, income monopolizes with 63.5%, compared to 36.5% for sale. And as for the subsector, it is the residential sector that has the highest percentage of demand with 78.7%, while the corporate sector only registers 0.1%. According to Daniel Narváez, The biggest challenge is for the apartments for sale, since the demand is concentrated in the rent.

This explains that future real estate developments that will be built on Paseo de la Reforma and in the surroundings of the Historic Center, such as the tower that will be built on Avenida Juárez 93, Torre Porrúa on Avenida Juárez 56 or Barrio Letrán, in Eje Central and José María Izazaga, choose to offer the houses built in rent mode. First, says the Lamudi spokesperson, it is to capitalize in the short term “because if they are not going to sell their units, how are they going to continue building”, and secondly, to meet a market demand that is housing for rent.

“Searching for rental housing has always existed, but it was more forceful now with the pandemic because it made the population rethink. One thing is the fact that life can change at any moment, so people are no longer going to commit to paying for a property in 20 or 30 years when they do not know what is going to happen tomorrow, more so with economic uncertainty. This evolution of consumption habits means that people prefer to have this greater certainty that at any time they can change their residence without any economic repercussions, that is why these mixed-use products also have a lot of weight, ”says Narváez.

Do not miss:

The Reforma towers corridor will extend to the Historic Center

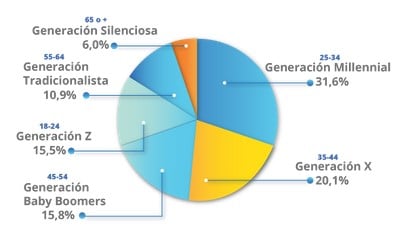

According to the 2021 Real Estate Report of Lamudi, son Millennials, Generation X, and Generation Baby boomers, in that order, those who accumulate greater participation regarding the search for housing in Mexico City. With a smaller participation are Generation Z and the Traditionalist.

The municipalities with the highest demand for housing are those that make up the so-called central city: Benito Juárez, Cuauhtémoc, Miguel Hidalgo and Coyoacán. Complete the top 5 the mayor Gustavo A. Madero. As for the colonies with the highest demand, they are Narvarte, Del Valle, Polanco, Roma Norte, Condesa, Álamos, Portales, Anzures, Napoles and Anáhuac, all of them with conditions to develop life schemes known as 15 minutes, that is, in a radius that requires 15 minutes of transfer, you can live, work, have leisure and stock up .

Follow us on Google News to keep you always informed