The trend is worldwide. Bank offices close in all countries and the branches that continue to operate do so with minimal staff. The emergence and massification of banking applications, added to ATMs, are changing the industry.

The problem is that millions are being left “outside” the system: the elderly and sectors with lack of connectivity.

In Spain, the banks seem to have understood that there is a difficulty there that they must resolve and based on the media coverage they announced a “change plan”.

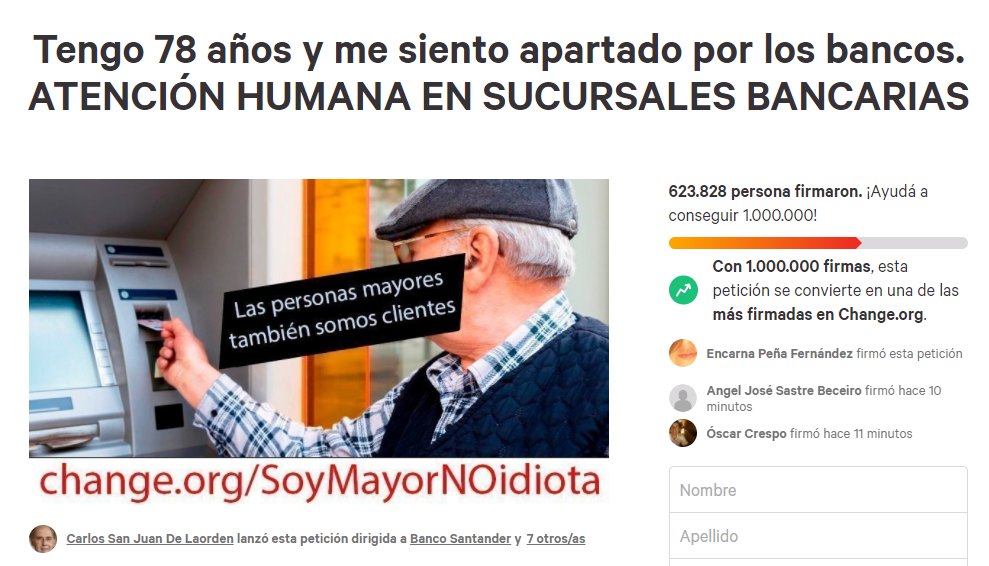

It all started when at the end of January a 78-year-old Spaniard, a retiree named Carlos San Juan de Laorden, started a petition on change.org calling for “human care for the elderly”.

“They do not stop closing branches, some ATMs are complicated to use, others break down and nobody solves your doubts, there are procedures that can only be done online. And in the few places where there is face-to-face attention, the hours are very limited, you have to make an appointment by phone, but you call and nobody answers. And they end up redirecting you to an application that, again, we don’t know how to handle. Or sending you to a distant branch that you may not have how to get to, ”says the petition from San Juan and published The country.

The petition went viral on social media and reached 600,000 signatures.

A week later, when the retiree’s request became increasingly mediatic, the Spanish government called on bank owners to “take measures” to review their financial inclusion protocols. He gave them a deadline: a month.

The plan of the Spanish banks to improve care for the elderly

Returning to the plan of the Spanish banks, this Wednesday, February 9, the president of the Spanish Banking Association (AEB), José María Roldán, said that the strategy consists of two paths:

a “shock” plan that immediately relieves the growing pressure on entities due to the problems of the elderly to be attended to in person, and medium and long-term measures of a more structural nature.

Roldán also said that there are other sectors, such as the public administration, that are not demanding the same thing that they are now asking of the banks after the media exposure of Carlos San Juan’s request.

He also said that the pandemic and the merger of two large entities in that country, CaixaBank and Bankia, made the problem worsen in recent months.

In Mexico, “physical de-banking” is also a trend and the recent sales and mergers of banks can increase the problem for older adults.