what is the voluntary financial exclusion?

Mexico has a financial inclusion problem and always has. Financial inclusion allows the growth of people and their families and contributes to a better quality of life. So why do we still have so many people excluded?

The premise on which all the country’s strategies and public policies on inclusion issues are based is that there is not a sufficient supply of financial products, or at least not throughout the national territory. That is the excluded do not have a nearby bank to which they can go, and therefore cannot have a basic savings account that integrates them into the formal financial system. But after all the government’s efforts to improve supply and accessibility, and not having the expected results, shouldn’t we perhaps reformulate the premise?

Is it true that it is a supply problem?

Before the advent of technology, regulators identified that it was not possible to place bank branches that covered all the municipalities of the country. This simply does not make any economic sense for the bank. For example, how can we include the 81 inhabitants of Jicotlán, Oaxaca, the least populated municipality in the Republic? Wow, couldn’t even get staff to run the branch.

So they focused on other alternatives to be able to offer financial services, such as the creation of Popular Financial Companies, Multiple Purpose Financial Companies, Savings and Loan Cooperative Societies, among other. The figure of Correspondent Banking was even created, in which banks can make use of the infrastructure of pharmacies and convenience stores to carry out basic financial operations. These ideas did contribute to improving inclusion, but they still did not have the expected effects, since it is still based on the premise that it is a supply problem and also depends on brick-and-mortar branches.

The new strategy in the inclusion attack is to eliminate the dependence on the physical. It is a good strategy. Now no branch is required to carry out financial operations, and it is much easier and more practical to be able to carry out operations from a computer or cell phone than physically going to a branch.

The Fintech Law to avoid voluntary financial exclusion

Part of this strategy falls on the Fintech Law, where figures are established that allow the opening of accounts to carry out operations (such as Electronic Payment Fund Institutions) or for credit and investment needs (such as Collective Financing Institutions). Of course, the digitization of banks also contributes, which, although they have not gotten rid of their branches, most of them already have a 100% digital option to open accounts or carry out operations. But if these strategies seem like the right ones to improve supply and inclusion, why did we have a drop in the percentage of the population that has at least one basic financial product, going from 68.3% in 2018 to 67.8% in 2021?

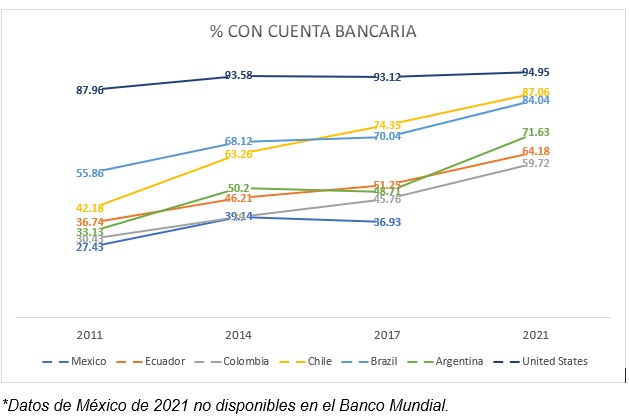

Therefore, we must change the strategy to focus on perfecting the offer. Today, anyone with Internet access on a cell phone, Internet cafe, or from her home could have access to financial products. Why then only 67.8% have access to a basic financial product? Even if we focus on the % of people who have access to a bank account according to the World Bank, Mexico is much further behind than other countries in the Americas, despite the fact that we have been pioneers in public policies that focus on the offer (such as the enactment of the Fintech Law that not even the US has):

Mexicans are deciding not to use formal financial products

So, if there is no lack of supply, what is happening to us? The answer is that Mexicans are deciding not to use formal products; that is, it is a voluntary financial exclusion. But if access to financial services opens up a world of opportunities, why are they choosing not to use these formal financial services? The answer is simple: lack of financial education.

Since we have the offer ready, we have to raise awareness and educate the demand so that they know the benefits of being part of the formal financial system: security in money management, immediate and remote transfers and payments, access to credit, access to investment. And that is where it seems to me that we have failed as a country.

The National Financial Education Week led by Condusef falls far short of what the country needs in terms of financial education. We need a holistic, general and mandatory program to teach our children about personal finance, and not one week a year, which is why we urgently need to implement personal finance in high school as a compulsory subject within the country’s curriculum.

It amazes me how such a simple subject, but with such an impact on quality of life, has been omitted for so long from the country’s academic life. Only in this way, I believe, will we finally begin to reduce the gap that many other countries have in accessing and using financial products. Let’s get rid of opt-out once and for all.